-With Gov’t spending entities not abiding by fiscal rules

By Frank Sainworla, Jr. fsainworla@yahoo.com

In the wake of a serious financial crunch, Finance Minister Samuel Tweah is recommending freeze in employment and that government should invest at least 20 percent of the annual budget to social and economic development.

According to the Quarterly Budget Performance Report (July-September 30, 2018) by the Finance Ministry dated November 2018, this has become necessary in order to “conduct a comprehensive analysis of the payroll of all spending entities in order to resolve issues of payroll deficits.”

One justification given in the report for the decline in percentage of the budget devoted to public sector investment projects during the period is: Government’s immediate intervention by providing employment for more than two thousand people in sectors such as Health and Education.

This, the report says, increased the recurrent component of the budget.

However, critics of the CDC government, which came to power over one year ago, say massive recruitment of supporters of President George Weah into various Ministries and agencies without respecting the Civil Agency’s standing rules is the real reason responsible for the bloated government payroll.

For its overall handling of the Liberian economy, the CDC government has come under serious criticisms from opposition politicians and others.

One of them, the former Presidential candidate of the Alternative National Congress (ANC), Mr. Alexander Cummings said on the popular Costa Talk Show last January:

“The economy is so bad and it is clearly known that President Weah is running the country without any sense of direction. His government is working as if it does not have a plan through which its development agenda can be executed,”

The ANC leader added: “What I can say to the Liberian people is that your suffering is tied to the rampant broad day stealing now being carried out on your nation’s resources by Weah led government. I speak facts and I don’t only criticize but suggest solutions. The only thing is that they are not taking our pieces of advice.”

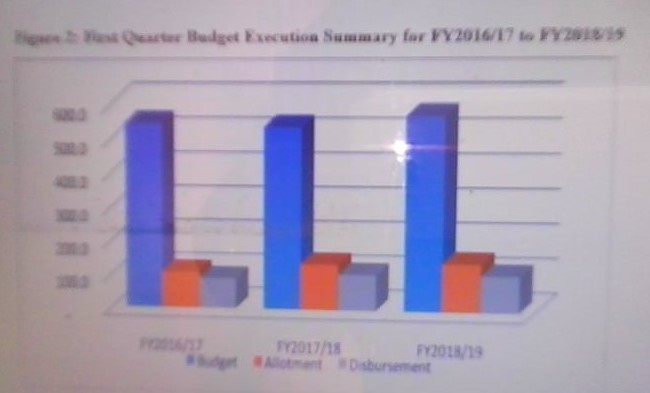

During Quarter One of Fiscal Year 2018/19, US$110.1 million was collected against a projection of US$105.5 million, according to the report.

Similarly, the Finance Ministry report says US$142.4 million was allotted, implying that the allotment was 29 percent in excess of the collected revenue for the reporting period.

On the other hand, almost all the revenue collected during this period was spent, as the report says US$ US$103.5 million (94 percent) was disbursed representing 94 percent of the collected revenue.

This is why the report is recommending that by directing government’s expenditure towards public sector investment, it will have “greater social and economic impact, the Government should take deliberate actions,” something that will align expenditure in the public sector to development priorities in the Pro-Poor Agenda for Prosperity and Development (PAPD).

The Quarterly Budget Performance report also indicated that some government spending agencies are not abiding by financial rules with a recommendation to “ensure that spending entities abide by the fiscal rules.”

Another recommendation is to “enhance budget execution and ensure budget credibility and integrity by significantly reducing off-budget expenditure.”

According to the report, public spending in the past has been mostly directed towards recurrent expenditure to facilitate general government operations than towards public sector investment.

2018/2019 revised budget allotment

The FY2018/19 revised budget was allocated as follows: recurrent expenditure constitutes US$516.5 million (91 percent) and Public Sector Investment Projects (PSIPs) comprise of US$53.7 (9 percent). Comparatively, the FY2016/17 Budget consists of 5 US$479.1 million (87.5 percent) recurrent expenditure and US$68.4 million (12.5 percent) PSIP. Similarly, the FY2017/18 Budget comprise of US$485.6 million (90.6 percent) recurrent expenditure and US$50.6 million (9.4 percent) PSIPs. This indicates that PSIPs constitute 9 percent of the FY2018/19 Budget compared to 12.5 percent of the approved budget in FY2016/17 and 9.4 percent 2017/18.