How Under Declaration Of Dividends By Liberian State Enterprises One Of The Hurdles

By Frank Sainworla, Jr., fsainworla@yahoo.com

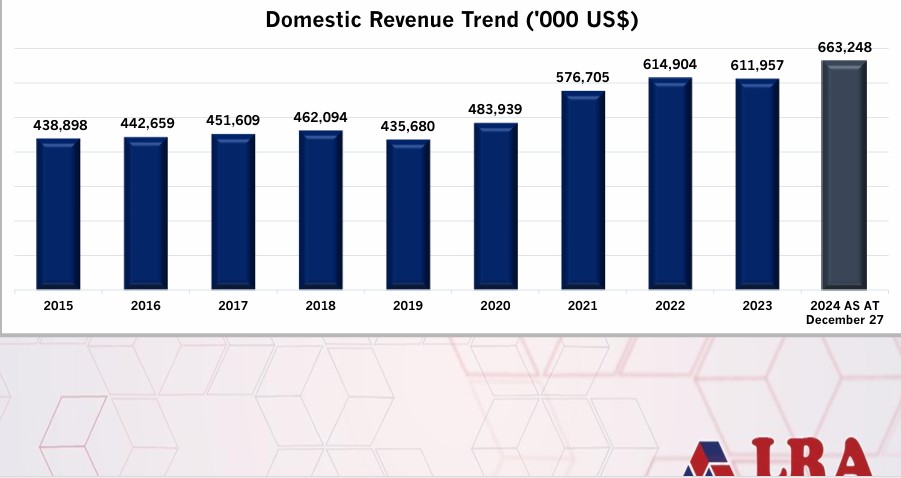

On the road to hitting its US$1 billion target to raise annual revenue for the government, the Liberia Revenue Authority (LRA) says its beefing up measures through upgrading its human resources and digital transformation, but while trying to hit one billion, its goal of meeting the US$738 million target for this year, 2024 has hit a snag.

Judging by the look of things, LRA will have to not only streamline measures to raise more revenue from the private sectors and concession companies but tighten the screws to ensure that State Owned Enterprises (SOEs) raising revenues give the expected huge, required dividends many are getting into the national pot. But with the look of things, this is likely to be an uphill task for the LRA, as at December 28, 2024, the LRA has been unable to raise the projected US$27 million from SOEs dividends, LRA Commissioner General, James Dorbor Jallah disclosed at a media engagement held at a local hotel in Monrovia over the weekend.

“Clearly, we’ll not be able to meet target to raise the US$27 million due to “exogenous circumstances,” he told media executives and editors.

From all indications during the scrutinizing process of the 2024 draft budget while at the Legislature, there was no doubt that those SOEs were in the financial position to collectively contribute this to the national revenue pot. It’s understood that by digging deeper lately, two SOEs were booked, resulting into revenue officers managing to squeeze US1M from the two entities.

Earlier this year, the now reinvigorated Bureau of State Enterprises headed by Mr. Arthur S. Massaquoi completed a study and reported that some state enterprises have been under reporting their dividends and not conforming to basic standards required by law.

“We have already begun consultations with the Governance Commission, and a joint technical committee has been established, signaling the start of collaborative efforts to draft the new corporate governance policy. The joint initiative will focus on harmonizing SOE performance standards and improving operational oversight across the sector,” said Director Massaquoi at a MICAT press briefing after a study by his Bureau of State Enterprises.

Mr. Massaquoi added: “The current state of non-compliance among many SOEs speaks directly to some of the key challenges we are addressing through our reform initiatives.”

Over the years, audit reports have shown and it has been widely reported that many of the SEOs prioritize lavish spending exorbitant salaries and benefits to their top executives and luxury vehicles, thus underreporting their annual dividends, something that many tax paying entities in the private sector do, this news outlet has learned.

The World Bank, in a recent report indicated that the SOE sector of Liberia “poses a significant fiscal risk without sufficient oversight.”

Accordingly, the bank said, its review found that the SOEs need to perform better against the annual budget expectations regarding their net revenue generation and profitability.

Surely, it the LRA must hit its first $880 million and US$1 billion annual revenue collection target, the loophole must be closed in both the private and public sectors. Domestic tax collection amounts to 60% of all revenues collected by the LRA annually, says Ambrose Bonny, Manager for Transformation and Modernization (DTD) at LRA.

Indeed, in order to hit the US$1 billion target, authorities of the LRA must intensify their efforts to streamline procedures across land and sea borders, improve salaries and benefits of those personnel colleting government’s lawful revenues as well as take punitive actions against revenue officers who connive with tax payers to undercut payments with some entering their pockets for selfish aims.

At the same time, the Executive branch of government, which prepares the draft budget and Lawmakers who make allocations therein, must no longer be allowed to apportion the lion share of taxpayers’ money to their staggering salaries, allowances and huge fleet of luxury vehicles. Leaders in Liberia’s political bureaucracy must remember that as the national tax envelop gets bigger, citizens expect that spending on crucial sectors that directly impact their lives (health, education & social services) will get bigger.

Hitting the US$1 billion target without doing the latter will not only further dampen public confidence and trust in government, but dampen the public’s interest and enthusiasm about paying their taxes and on time.

This is particularly crucial in this era when international partners’ support to subsidizing our national budget is waning and is expected to decline further, with the state of the new world economic, political and security order.

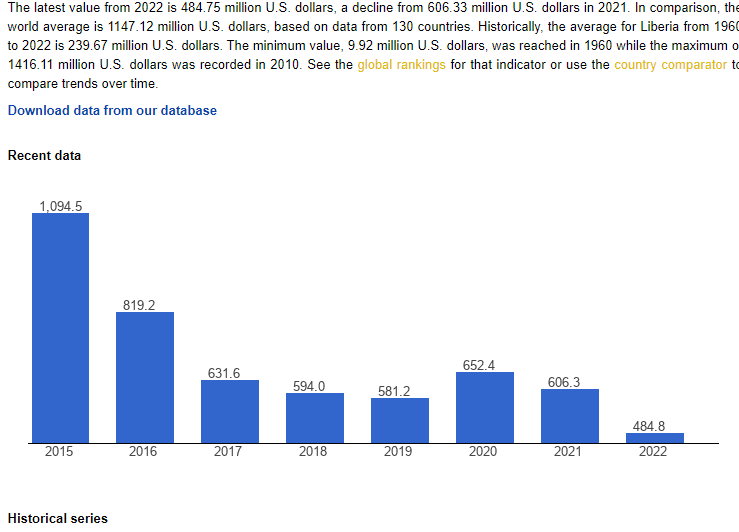

At his weekend engagement with the media on Saturday, December 28, 2024, LRA’s Commissioner General Jallah sent out a caveat about the urgent need for Liberia to look inward to raise financial resources to spur national development of this post-war West African state, which is ranked among the 10 poorest nations in the world, according to global development index. More and more, the foreign grants basket reaching this country have sharply been on the decline, the LRA CG pointed out quoting a report from the Organization for Economic Development (OECD), which shows that grants aid to Liberia from 2015-2022 has dropped from over US$289 million to over US$300 million.

According to a recent World Bank report, which is in line with Governance Global Practice -West and Central African Region, the SOEs in Liberia collectively lost US$7.4. million in Q1 2022 despite the budget’s projection that the sector would generate a US$14.6 million profit for 2022.

World Bank Liberia Country Manager, Madam Georgia Wallen said in late May this year: “Improving Governance of SOEs and Reducing Fiscal Risks Improving Governance of SOEs and Reducing Fiscal Risks” organized by the by the Bureau of state enterprises with support from the World Bank.”

Although the LRA boss is optimistic about the prospects of Liberia climbing its annual revenue collection to US$1 billion in about a year’s time, the Revenue Authority is said to be facing some serious constraints, ranging from lack of financial autonomy to shortage of auditors and technical manpower to restructuring of the country’s tax system. To combat the problem of under declaration by tax paying entities the LRA is craving to hire some 304 Auditors to close up some loopholes on the road to meeting the US$1 billion target.

This is one thing some analysts say our Lawmakers must give priority to. For example, instead of allocating US$45,000.00 for the purchase on one vehicle to each of the 103 Senators and Representatives every three years, Lawmakers must put the ‘money where the country’s mouth is’, in order to boost domestic tax revenue generation.

“Our focus now is closing up the leakages that will make it possible to raise revenue collection to US$1 billion in a year,” LRA’s CG James Dorbor Jallah intimates.