Author: Emmanuel Dweh Togba, PhD Candidate at Dukuz Eylul University in Izmir, Turkey. Email: etogba95@gmail.com

High inflation in Liberia seems to be a common and persistent phenomenon. Between 2000-2019, the annual average consumer price inflation was a double-digit—averaging 10.88% according to official IMF data. What has been the cause(s)? How can this situation be curtailed?

Let’s take a peek at the definition of inflation before seeking answers to these questions. Generally, inflation, in no way, means an increase in prices. This is true because increase in price alone—whether for a few products or for a one-time increase—doesn’t constitute inflation, rather an increase in the price of all products and services. Essentially, inflation is the continuous increase in the general price level.

There are, however, two major factors that account for inflation: one arising from increase in demand and the other from increase in the cost of production.

Price stability is notably a fundamental goal of every central bank and the struggle with maintaining low inflation is undoubtedly an important policy goal of Liberia. To achieve this objective of reducing inflation, we need to understand the main cause(s). Economics theories provide various approaches to determining sources of inflation. Some widely accepted theorizing of inflation’s source include the monetarists view and the fiscal theory of price level (FTPL). Additionally, external factors including prices of major global commodities, have been discovered as key sources of inflation especially in import-dependence economies.

Monetary economists postulate that inflation is a monetary phenomenon. This is, by far, the most widely accepted view on inflation. It is based on the quantity theory of money and indicates that inflation is determined by the relative supply of money and goods. In this context, reducing inflation would entails reducing money growth to be on same path with growth of the economy.

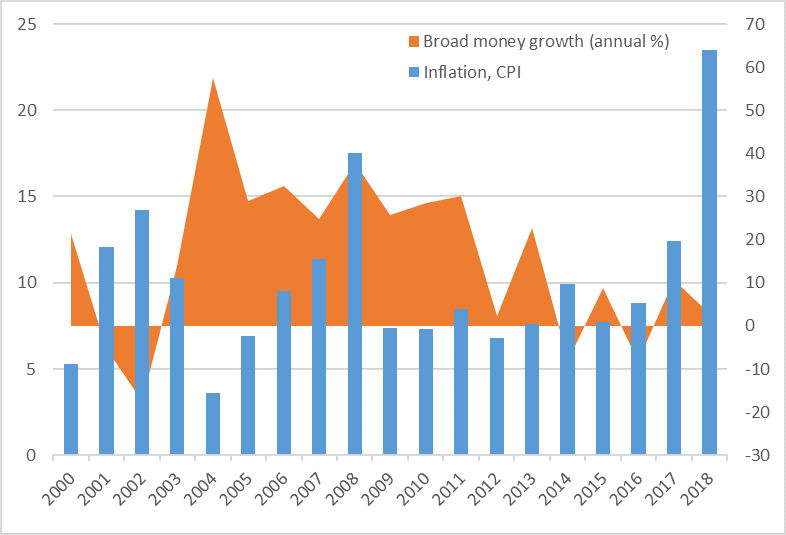

Liberia’s broad money growth has witnessed a huge reduction since 2013. This might have been an intentional effort by the CBL to curb inflation. But as displayed in the graph A below, money growth doesn’t seem to be responsible for changes in price level during the period between 2000-2018. In 2004, for example, broad money growth was at its highest peak of 57.5%, while inflation was at its lowest of 3.6% during the period under review, from 2000-2018. An exactly opposite situation occurred in 2018, when broad money growth was 3.03%, a relatively low level, and inflation was 23.5%–the highest in sub-Saharan Africa (with the exception to Zimbabwe). In 2019, annual CPI was recorded at 27%, the highest inflation rate ever reported in Liberia—probably excluding wartime periods.

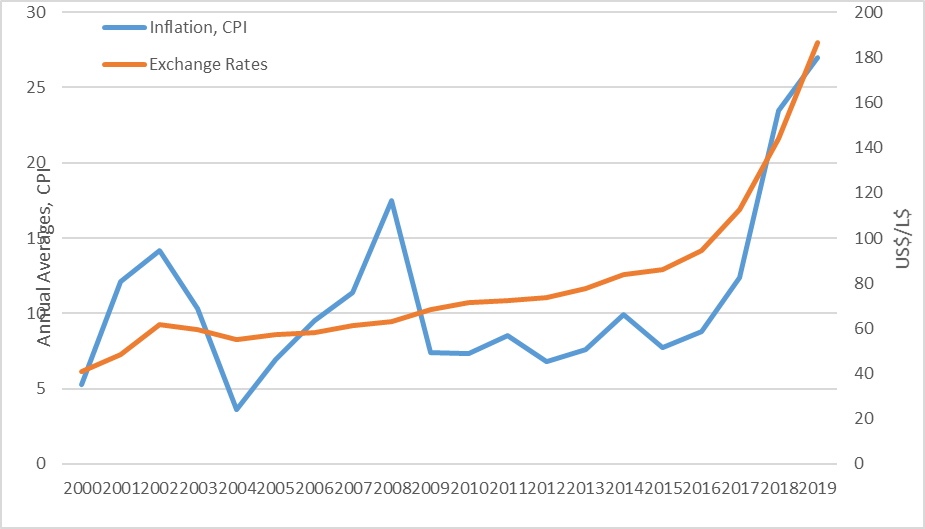

Inflation in Liberia certainly look nothing like a monetary phenomenon—broad money growth doesn’t seem to account for increase in inflation between 2000-2018. However, the idea of an exchange-rate pass-through seems true for Liberia when considering the inflation and exchange rates values beginning from 2015 as indicated in graph B. This measure of exchange-rate pass-through considers the responsiveness of a local currency price of foreign currency. So, given Liberia’s high demand for imported products, depreciation in the exchange rate (here, the cost of United States dollars in Liberian dollars) means that Liberians have to pay higher prices for imported goods. With the existing low productive capacity level, consumers don’t have the luxury of choice to shift to locally made products, thereby forcing them to continue to buy foreign products even while experiencing reduction in their purchasing power.

Graph A. M2 growth and Inflation, 2000-18 Graph B. Inflation and Exchange Rate, 2000-19

Source: IMF database and WDI

Note: Broad money annual growth rate is on the right axis. Inflation rate is on the left axis.

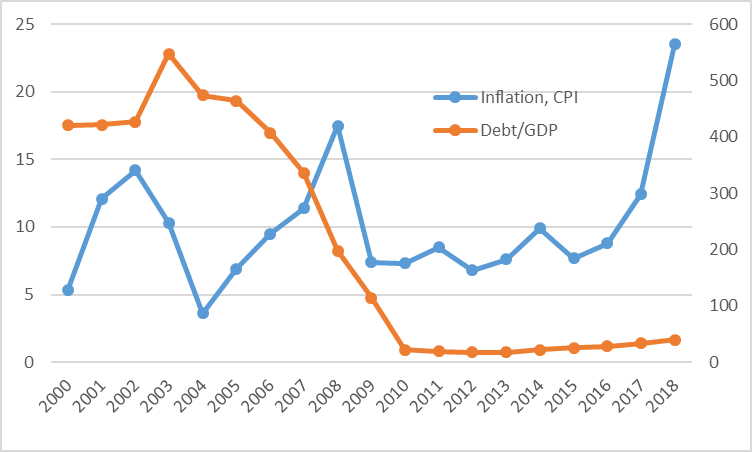

If inflation is not a monetary phenomenon and, as it seems, an exchange rate pass-through does exist for Liberia, what else could be the source of Liberia high inflation? Another inflation source theory mentioned above is the fiscal theory of price level. FTPL, among other things, considers government/public debt effect on wealth, and as a means of fiscal influence on inflation. This theory further indicates that higher public debt increases household wealth and hence, demand for goods and services thereby leading to increase in price level. Government debt levels in Liberia averaged 212.4% of GDP between 2000-2018 and 25.1% between 2010-2018. The dramatic fall in debt levels beginning in 2010 was mainly as the result of Liberia completion of the Heavily Indebted Poor Countries Initiative (HIPC) and being relieved of debt amounting to US$4.6 billion. In 2018, debt-to-GDP ratio was recorded at 39.9% of GDP and is expected to increase even further at the end of 2020 due to low revenue mobilization, and huge borrowing that accompanied the coronavirus pandemic. Debt levels and Inflation are moving in similar shape and in similar trend especially after 2010, indicating that increase in public debt could account (at a low or medium magnitude) for changes in price level in Liberia. Thus, higher inflation could be expected by the end of 2020, with the rising debt levels currently being experienced.

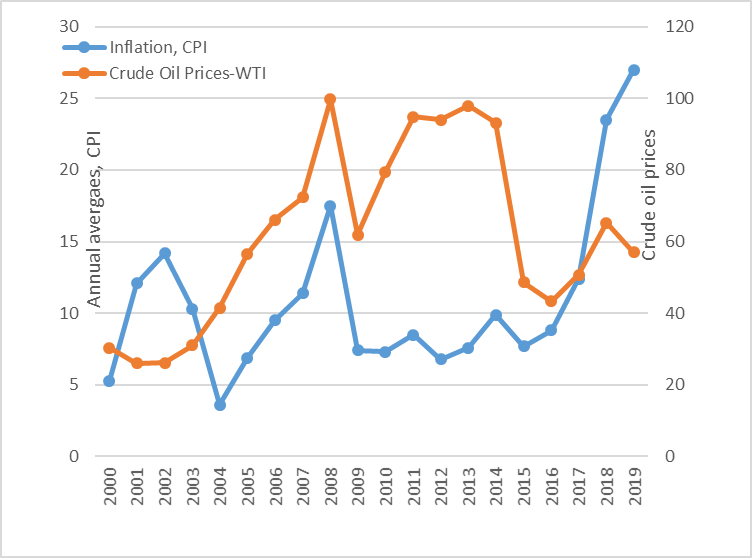

Graph C. Inflation and Debt, 2000-2018 Graph D. Inflation and Crude oil price, 2000-2019

Source: IMF database and Federal Reserve of New York

Note: Debt/GDP rate on the right axis. Inflation rate is on the left axis.

External factors including the global prices of key commodities (notably crude oil) account for changes in inflation in many economies. The importance of energy and the geographically unbalanced distribution of energy resources increases many countries dependence on imported energy. Consequently, an increase in the price of energy negatively affects the local economies of countries highly dependent on import of energy, Liberia not being an exception. Generally, and as evident elsewhere, food prices account for majority of inflation. Since food prices are themselves affected by energy prices, it can be said that energy price made up a huge portion of total inflation. As a country, Liberia continues to face challenge with energy supply. Energy cost accounts for a huge portion of local firms’ production/operational costs. When we consider the graph below, beginning 2004, inflation and crude oil price seem to follow the same fluctuation pattern—moving in the same direction. This makes it possible to say that changes in price level in Liberia is mainly due to movements in global price of crude oil.

Has monetary policy been effective in combating inflation? The answer may be more like a “yes” and “no”. When we consider inflation values between 2009 and 2015, we noticed that inflation was relatively low hovering around a single-digit. Therefore, yes, monetary policy has been successful particularly in the short-term in maintaining price stability to a certain extent. However, from 2015 to 2019, inflation surged swiftly averaging 15.88% annually. As it is observed, the biggest factors accounting for inflation to this point are the depreciation in exchange rate, the high debt levels recorded over the years and the increase in production cost due mainly to the high cost of energy. Keeping in mind that Liberia’s economy has a highly import-based structure, fluctuations in global commodities prices are reflected in the production cost local firms are faced with which is translated to cost inflation.

Liberia’s low productive capacity makes the situation even worst. Import is relatively high and accounts for a huge portion of intermediate and final household consumptions. Knowing that higher prices are fuelled by high production cost, the best policy would be to ensure firms reduce their costs and subsequently the price of their products and services.

This could help combat inflation but certainly is not a means to an end. Liberia needs to find a way to increase its productive capacity using local raw materials to produce final goods. While doing these, a tighter fiscal policy should be in place. At this point, both monetary policy and fiscal policy need to be parallel, displaying more coordination in achieving price stability and growth. Liberia’s vulnerability to external shock has been exposed in many instances and policymakers need not tarry in strengthening and building the resilience of the Liberian economy to external shock while, at the same time, ensuring macroeconomic stability and economic growth and development.