ANALYSIS By Boima S. Kamara

EDITOR’S NOTE: The Author is former Minister of Finance during the government of former Liberian President Ellen Johnson Sirleaf. Earlier, Mr. Kamara served as Deputy Governor of the Central Bank of Liberia (CBL)

This article attempts to shape academic debates on public debt performance and the direction of fiscal policy in Liberia, especially in the context of Liberia’s debt carrying capacity. Also, the article is intended to help inform discussions during budget hearings on the FY20/21 proposed budget now before the Legislature for passage.

Prior to the commencement of the Sirleaf administration in 2006, Liberia had a staggering unsustainable public debt stock of US$4.9 billion with a debt-to-GDP ratio over 80 percent beyond the 75.0 percent unsustainable threshold level; a situation that led the country to be classified by the IMF as a Heavily Indebted Poor Country (HIPC). Despite the huge debt inherited, the administration of former President Sirleaf worked assiduously with the international community to have a significant portion of the debt waived after reaching HIPC Completion Point in June of 2010. The pre-HIPC debt level stood at US$383.04 million at end-June 2010 after several negotiations and debt restructuring which helped to free up resources for growth and development and put the country back on track with a normal and sustainable debt level.

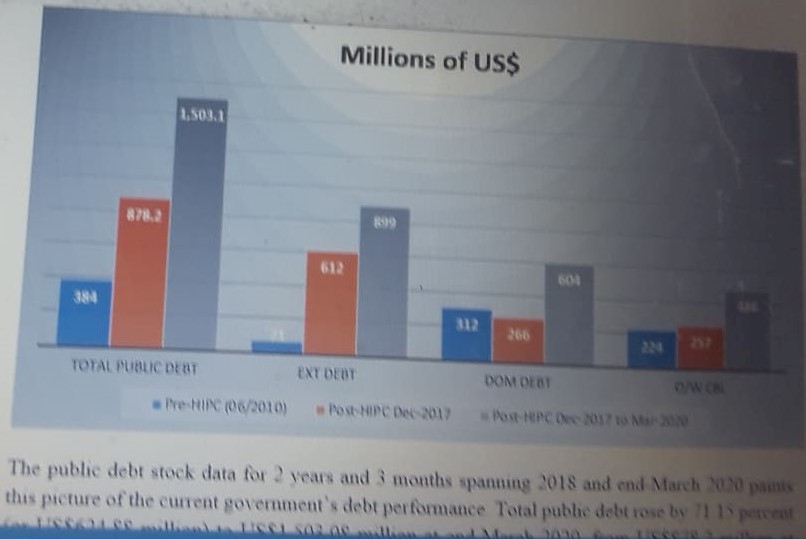

After careful review of debt statistics in recent publications by the Ministry of Finance and Development Planning (MFDP) and the Central Bank of Liberia (CBL), Liberia’s total public debt rose by 81.2 percent (or US$565.85 million) to US$878.2 million, from US$383.04 million over the last 7-year period ending the Sirleaf Administration in December of 2017. External debt rose by 765.3 percent (US$541.45 million) to US$612.2 million, from US$70.75 million while domestic debt decreased by 14.80 percent (or US$46.24 million) to US$266.10 million, from US$312.43 million during the same period. However, domestic debt owed CBL grew by 15 percent to US$266.10 million during the period of 7 years. It is important to note that the loan owed the CBL by the government is largely driven by legacy loan[1] accounting for US$223.55 million of the total pre-HIPC debt stock of US$312.34 million and US$257.08 million of post-HIPC of US$266.10 million at end-2017. Thinking outside the box is necessary, which requires the government working in concert with the CBL and the IMF to ameliorate this drag on domestic debt. For example, waiving the legacy loan (something which outside creditors did for Liberia upon reaching HIPC Completion) and at the same time making arrangement through the budget over 5 to 10 years to capitalize the CBL. The data also shows that at the close of the Sirleaf Administration, debt owed commercials banks was US$10 million at end-2017 (see Chart below).

[1] It is a legacy loan because it predates the Administrations of Madam Sirleaf and President Weah by over 2 decades.

The public debt stock data for 2 years and 3 months spanning 2018 and end-March 2020 paints this picture of the current government’s debt performance. Total public debt rose by 71.15 percent (or US$624.88 million) to US$1,503.08 million at end-March 2020, from US$878.2 million at end-2017. Of the total stock of public debt at end-March 2020, external debt accounted for US$898.68 million and domestic debt, US$604.40 million. In terms of movements, external and domestic debts grew by 46.8 percent (or US$286.48 million) and by 127.13 percent (or US$338.3 million), respectively. GoL’s borrowing from the CBL increased by 88.92 percent (or US$228.62 million) to US$485.70 million, from US$257.08 million at end-2017, followed by commercial banks with a growth of 552.2 percent (or US$55.22 million) to US$65.22 million, from US$10 million for the same period. Of the US$65.22 million, LBDI, Ecobank, and IB account for over US$50 million. Recently, the government cancelled a US$65 million facility with the AFREXIM Bank that already received approval from the bank intended to liquidate debt owed the banking institutions. Further delays on the part of the government to settle its obligation to the banks have the proclivity to worsen the existing liquidity squeeze confronting the financial system. We anticipate that provision was made for this in proposed FY20/21 budget before the legislature.

The data reveals government borrowing from NASSCORP to the tone of US$50.56 million at end-March 2020. While we are fully cognizant of the tight fiscal space that is further complicated by the current global health crisis, it is hoped that appropriate collateralization process was in place to ensure timely repayment bearing in mind that a delay in repayment translates into a delay or potential denial of civil servants’ pension funds benefits to retirees or other benefits. It is important to point out that for fiscal year ending FY18/19, US$88.82 million was GoL’s borrowing from the CBL largely in the form of bridge loan of US$28 million; FY18/19 Escrow Account in US dollars, US$16.25 million; FY18/19 Escrow Account in Liberian dollars converted to US dollars, US$14.70 million; and Other Claims (there is a need to know what constitutes “Other Claims”) in Liberian dollars converted to US dollars was US$29.87 million. The Liberian-dollar equivalents of US$14.70 million and US$29.87 million (totaling US$43.87 million), using as a proxy for fiscal dominance (a situation where the national debt rises too quickly with a risk of debt distress and inability to repay), means a high level of deficit financing by the CBL through expansion of Liberian dollars in circulation by over L$8.0 billion. This seems to be one of the key factors that led to the rise in inflation to 30 percent during 2019 on the heels of rapid exchange rate depreciation averaging about 30 percent to L$186.64/US$1 at end-December 2019.

In conclusion, the data shows a remarkably high rate of growth in public debt within 2 years 3 month of the current administration, compared with post-HIPC 7 years of the Sirleaf administration that ended in 2017. Fiscal dominance is slowly creeping given the borrowing pressure on the CBL, which runs contrary to the spirit of fiscal-monetary complementarity. In this regard, we advocate for greater support for the independence of the CBL as the monetary authority. At end-June 2020, the IMF and World Bank jointly classified Liberia’s risk of debt distress as MODERATE, something to claim the attention of policy makers. The debt-to-gdp ratio for Liberia has risen from around 30 percent during the Sirleaf Administration to 51.33[1] percent at end-March 2020. The journey of life after debt is calling for appropriate fiscal rules and tougher vetting of future debt, which should be mainly for growth enhancing projects with high economic returns and not for CONSUMPTION. As the budget hearing process starts, we call on the legislature to consider the facts above during the deliberations surrounding the proposed FY20/21 budget.

DISCLAIMER: The views expressed in this article are solely the author and all inquiries should be addressed to kamaraboima@yahoo.com

Appendix: Table 1: Highlight of GoL Debt Performance (Millions of US$)

| *Pre-HIPC (06/2010) | Dec-2017 | Change | ||

| Total Public Debt | 383.04 | 878.20 | 565.85 | 81.2% |

| External | 70.75 | 612.20 | 541.45 | 765.3% |

| Domestic | 312.34 | 266.10 | -46.24 | -14.80% |

| Financial Inst’s | X | 266.10 | X | X |

| o/w CBL | 223.55 | 257.08 | 33.53 | 15.0% |

| CoBanks | X | 10.00 | X | X |

| Dec-2018 | Mar-2020 | Change | ||

| Total Public Debt | 1,039.90 | 1,503.08 | 463.18 | 44.54% |

| External | 774.90 | 898.68 | 123.78 | 15.97% |

| Domestic | 265.00 | 604.40 | 339.40 | 128.08% |

| Financial Inst’s | 264.60 | 550.92 | 286.32 | 108.21% |

| o/w CBL | 255.46 | 485.70 | 230.24 | 90.13% |

| CoBanks | 10.00 | 65.22 | 55.22 | 552.2% |

| LBDI | 32.08 | |||

| Eco | 11.57 | |||

| IB | 10.05 | |||

| UBA | 4.39 | |||

| GT | 3.03 | |||

| Afriland | 2.75 | |||

| GN | 1.38 | |||

| NASSCORP | 50.56 | |||

| MEMO ITEMS (GoL debt w/CBL) | Millions of US$ | |||

| 1.CBL Bridge Loan (2019) | 28.00 | |||

| 2.FY18/19 Escrow Acct (US$) | 16.25 | |||

| 3.FY18/19 Escrow Acct (L$ in US$) | 14.70 | |||

| 4.Other Claims (L$ in US$) | 29.87 | |||

| Total | 88.82 |

* Pre-HIPC restructured debt refers to the portion of renegotiated/restructured public debt before the debt relief program in 2010.

X= data not available

Source: MFDP’s DMU 3rd Quarter Report FY19/20, MFDP’s Annual Public and Publicly Guaranteed Debt Report FY18/19 and CBL 2019 Annual Report

[1] Using IMF projected nominal GDP of US$2,928 million for 2020